Debt financing risks are a crucial consideration for any business undertaking significant investments. A poorly managed debt load can easily stifle growth and even lead to financial disaster. Debt financing involves securing capital through loans, bonds, or other forms of borrowing to fund investments. Understanding the potential pitfalls and proactively managing leverage is essential for avoiding unnecessary risks and maximizing the return on investment. This comprehensive guide will delve into the key risks associated with debt financing, providing you with actionable strategies for managing leverage and ensuring the long-term success of your investments. The structure of this article covers an overview of debt financing risks, followed by a detailed analysis of leverage management strategies, concluding with actionable insights for mitigating risks and enhancing financial outcomes.

Understanding Debt Financing Risks

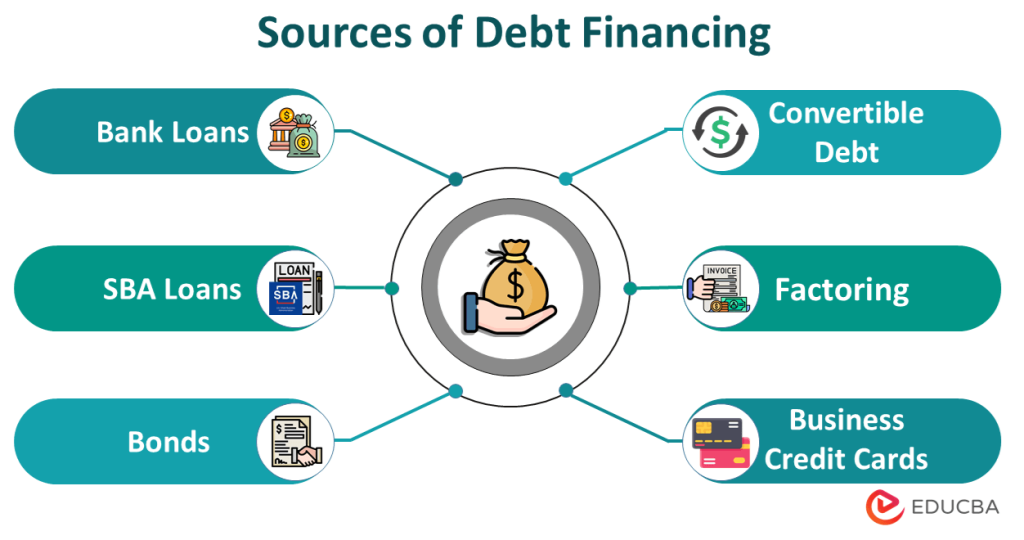

Debt financing offers substantial opportunities for business growth, but it’s not without inherent risks. These risks stem primarily from the challenges of managing leverage, the extent to which borrowed capital is used relative to equity capital. Leverage can amplify both profits and losses; a well-managed debt portfolio can fuel expansion, but excessive debt can quickly lead to financial distress. One of the key risks is the potential for interest rate fluctuations. Changes in interest rates directly impact the cost of borrowing and can significantly impact profitability if not carefully considered.

The Importance of Managing Leverage

Assessing Debt Capacity

Understanding a company’s debt capacity is critical for effective debt financing management. A thorough financial analysis, encompassing income statements, balance sheets, and cash flow statements, is essential to determine the optimal level of debt a company can comfortably support. Overextending on debt can have catastrophic consequences, hindering long-term financial stability. This includes evaluating both current and projected cash flows. A realistic assessment of projected revenues and expenses is critical in determining the maximum amount of debt that can be serviced without jeopardizing profitability.

Managing Interest Expenses

Interest expense is a major consideration when assessing leverage. Fluctuations in interest rates can significantly impact a company’s financial health. Companies need to factor in the potential volatility of interest rates when evaluating their long-term financial position. Implementing interest rate hedging strategies can effectively mitigate some of this risk.

Considering Default Risk

Debt financing carries inherent default risk, where the borrower fails to meet their debt obligations. Companies must carefully assess their ability to repay borrowed funds. This risk is further increased with higher debt levels.

Identifying and Mitigating Debt Financing Risks

Risk Assessment Strategies

A structured approach to risk assessment is critical for successful debt financing. By identifying potential risks and implementing mitigation strategies, businesses can ensure their financial viability. A thorough analysis of financial statements and an evaluation of market conditions can provide valuable insight into potential risk areas. This should include a deep dive into industry trends and economic indicators that could affect the company’s ability to meet its debt obligations. This kind of diligent planning is critical to successful capital management. Analyzing historical trends can also help predict future challenges. For example, if past periods have seen economic downturns followed by significant loan defaults, implementing preventative measures can ensure better outcomes.

Building a Strong Financial Plan

Creating a detailed financial plan is essential for successful debt management. This plan should encompass realistic projections of future cash flows, revenue streams, and expenses, and should be periodically reviewed and adjusted as circumstances change. A robust financial plan demonstrates a clear understanding of the company’s financial position and its potential to manage debt obligations effectively.

Case Studies and Examples

Case Study: Company X

Company X, a rapidly growing tech startup, took on significant debt financing to fund expansion into new markets. However, they failed to adequately project revenue growth and experienced a downturn in sales. This led to difficulty in meeting debt obligations, highlighting the importance of realistic financial projections in debt financing. The case serves as a cautionary tale, emphasizing the need for thorough due diligence and realistic revenue projections.

Example: Interest Rate Risk

Rising interest rates can dramatically increase the cost of borrowing for businesses with substantial debt financing. A company relying heavily on variable-rate loans becomes more vulnerable. The impact is compounded when the projected income stream cannot sustain the increased interest obligations.

Conclusion

Debt financing plays a vital role in supporting business expansion, but understanding and effectively managing debt financing risks is crucial for long-term success. By implementing robust risk management strategies, investors can enhance their likelihood of realizing positive financial returns. By analyzing potential risks, creating realistic projections, and focusing on sound financial planning, businesses can mitigate the negative impact of debt financing and navigate economic shifts more effectively. A comprehensive financial plan, along with rigorous monitoring of market conditions, is essential. This comprehensive guide empowers you to take calculated risks and maximize the rewards of debt financing.

Further Considerations

Additional Topics

Frequently Asked Questions

What are the key factors to consider when evaluating debt financing options?

The key factors to consider when evaluating debt financing options include assessing the financial health of the company, evaluating the availability of financing options, considering the terms and conditions of the available debt, and understanding the potential risks associated with each option. Careful consideration of each factor is paramount. A company should understand the specific terms of the agreement, the required financial documentation, and the potential penalties involved in defaulting on the loan.

How can businesses mitigate the risks associated with fluctuating interest rates?

Businesses can mitigate the risks associated with fluctuating interest rates by using interest rate hedging strategies. These strategies involve locking in an interest rate or using derivative instruments to manage the impact of fluctuating rates. By understanding the dynamics of interest rates and their potential impact, companies can proactively safeguard their finances against these fluctuations and reduce the associated risks.

Debt financing, while offering significant opportunities for business growth, carries inherent risks, primarily stemming from the management of leverage. Understanding these risks, coupled with sound financial planning and strategic decision-making, is crucial for successful investment. By thoroughly analyzing the potential pitfalls, investors can mitigate the downsides and increase the likelihood of achieving profitable returns. Thorough due diligence, realistic projections, and the establishment of a strong financial management plan are essential steps toward capitalizing on debt financing opportunities while navigating the associated risks. For further analysis, exploring comprehensive resources on investment strategies and financial management is recommended.